The Easiest Form of E-Invoice Integration is in Korivus

Effortlessly manage your e-invoicing processes with Korivus. Create, send, and archive all your invoices from a single platform; save time by reducing manual workload. Experience the speed and ease of integration with Korivus.

Collect Your Payments Quickly

Prepare your invoices easily, send them to your customers with a single click, and manage all your invoice processes effortlessly from a single screen.

Create Your Invoices Quickly and Effortlessly with Ready-Made Templates.

Eliminate paper and toner costs; don't waste time with mail or shipping processes. Easily manage your invoices from anywhere, anytime.

Archive Your Invoices Digitally

Say goodbye to the hassle of storing physical invoices; instantly access all your invoices digitally. Reduce your workload and enjoy the convenience of easily accessing your past records whenever you need them.

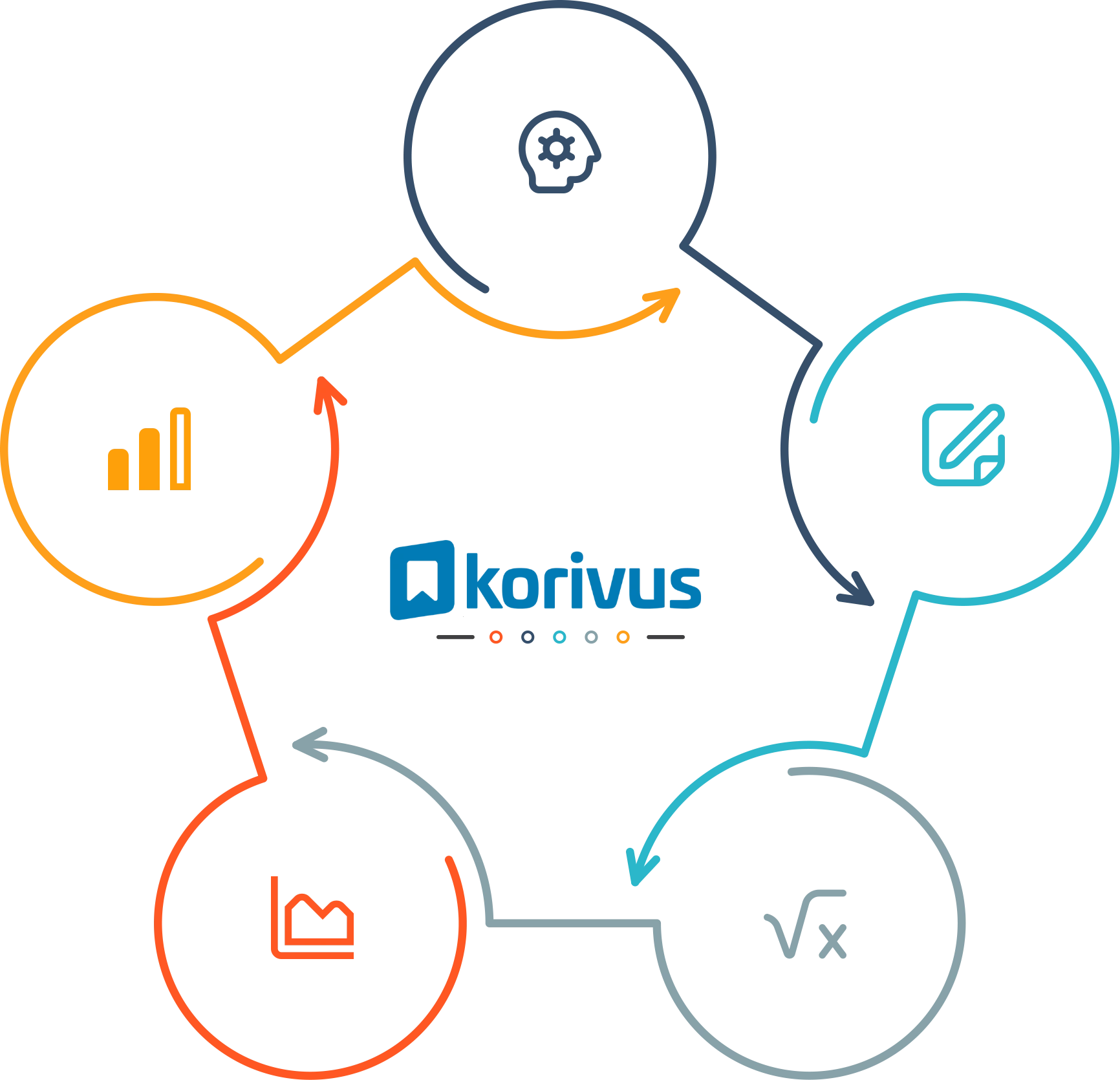

Powerful and Effective Solutions in E-Invoice Integration

Track your income and expenses completely, make plans based on your financial data with finance and accounting management applications. Prepare, approve and integrate your invoices quickly and without errors. Perform fast, secure, cost-effective and error-free transactions.

Cash and Bank Tracking

Easily record your cash and bank transactions and instantly view your balances. Manage all your financial processes, including cash outflows, transfers, and check and promissory note transactions, more efficiently and effectively.

Cash Flow Management

Track your daily income and expense transactions, expenses, and advance payments all from a single dashboard. Effortlessly view and manage your payments, invoices, and pro forma statements, taking control of all your financial processes from a central location.

Budget Planning

Create your budget, compare planned and actual income-expense items, and examine the differences and realization rates in detail.

Advance Tracking

View any person or company from your current list and quickly organize and control the premium and advance transactions of this account.

Expense Management

Prepare expense forms for various categories, such as travel, meals, and transportation. Include authorized approval steps, such as the manager, finance, or general manager, in the process by defining approval flows.

Check and Bill Tracking

View all transactions, whether issued or received, of your checks and bills in a single list; instantly access their maturity dates and current status.

Asset Management

Classify your fixed assets according to branches, assign them to relevant branches, assign them to personnel and relate them to other fixed assets when necessary.

Payables and Receivables

Identify your payable and receivable types, define your payment methods, and regularly monitor all due dates. Easily access customer payable and receivable information, whether current or current, from a single screen.

- How can I keep track of payables and receivables?

You can monitor your financial status according to debt and receivables categories and plan your payment and collection processes.

- How can I manage my expenses?

You can create expense forms for different categories such as travel, food, and transportation; define approval steps, and add authorities such as managers, finance, or general managers to these steps.

- What are the general applications of Financial Accounting?

Expense management, budget planning, cash flow management, cash and bank tracking, check and promissory note tracking, fixed asset management, advance tracking, payable and receivable tracking applications are the general applications of finance and accounting management.